SPX Price Appears to be Detached from the Trend. Time for a Healthy Retreat?

Last Friday was a bad day for the greenback and quite positive for the US equities. USD index fell to 93 points as the greenback made deep retreat against both majors and EM currencies. Gold burst through resistance at $1920 (scenario we discussed last Friday) thanks to the efforts by the Congress and the White House to forge a stimulus deal for the economy. This theme should continue to command a spotlight for equity market and US Dollar this week, so let's take a closer look at it.

On Monday, futures opened positive, continuing to rise on Friday's optimism. President Trump, in a remarkable U-turn, changed his tone, offering to negotiate on $1.8 trillion relief package - just $400 billion less than what the Democrats proposed. Just a few days before Friday, Trump tweeted that he ordered to completely halt negotiations with Congress on the deal.

Trump's party colleagues were unhappy with the president’s move. With Republicans in control of the Senate, Trump will have to convince his colleagues to get the negotiations off the ground. So, by itself, Trump's tweet on Friday should be a limited fuel for the markets.

After a series of bear tests of 200-day SMA, frustrated sellers apparently eased their grip. Since October 6, the S&P 500 has been showing an aggressive, almost unabated rally and has significantly deviated from the trend (200-day SMA), which may indicate that it is overbought, setting the stage for a pullback. The recent buyers’ vigor is difficult to interpret in the context of a bear market, so considering any downside before the test of 3500 points as a bullish correction perfectly makes sense:

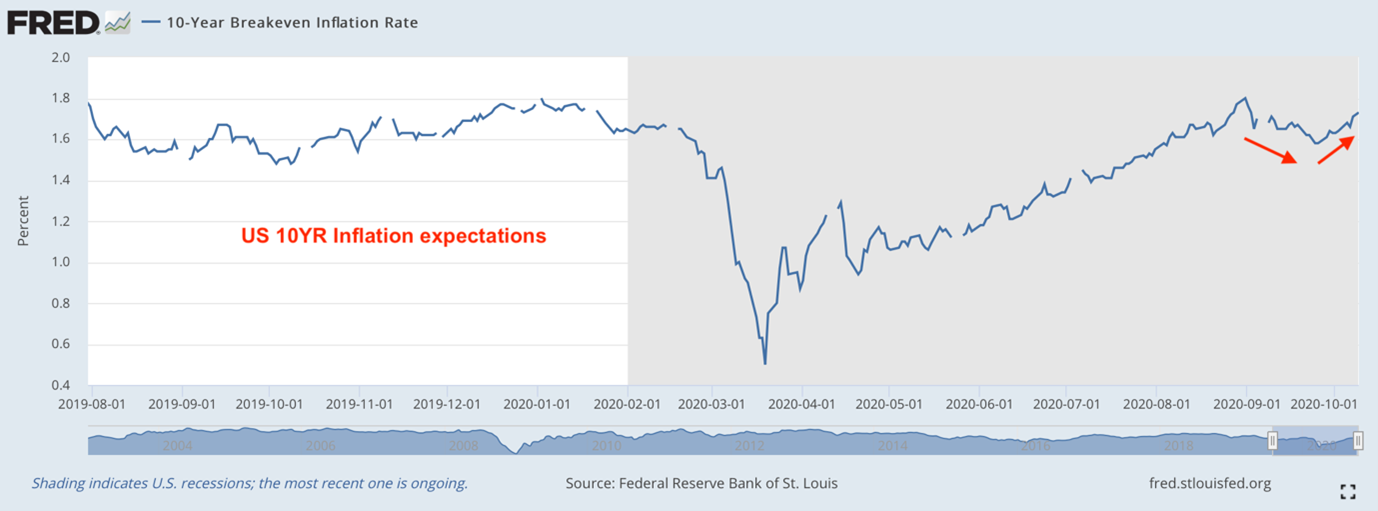

On Tuesday, important data on consumer inflation is due, andon Wednesday - production prices in the US. After a short retreat, debt marketscontinue to insist that inflation is accelerating in the US:

That is, the debt market is still telling us the same story as the stock market.

Any upside move in inflation should continue to build pressure on USD and be positive for continuation of the bullish rebound in US equities. In overall I continue to see solid case for recovery of SPX after healthy correction.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% and 75% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.