FTSE 100 FINISH LINE 22/10/25

FTSE 100 FINISH LINE 22/10/25

London's stock market saw gains on Wednesday, fuelled by growing optimism for potential interest rate cuts from the Bank of England. This came after surprising inflation data revealed that price growth remained steady, defying expectations. Meanwhile, Barclays stole the spotlight with a bold share buyback announcement that sent its stock soaring. Barclays surged 4.2%, emerging as the top performer on the FTSE 100 index. The bank unveiled a £500 million ($670 million) share buyback plan and raised its key profitability target for the year, energising the banking sector, which climbed 1.6% overall.

September's inflation rate held firm at 3.8%, coming in below the Bank of England's forecast of 4%. This has sparked speculation of a rate cut before the year ends. Market sentiment suggests a roughly 75% chance that the BoE’s Monetary Policy Committee will lower the bank rate to 3.75% from 4% at its December meeting—a notable jump from the 46% probability estimated prior to the fresh data. The unexpected inflation reprieve offers a glimmer of hope for finance minister Rachel Reeves as she prepares for November’s budget announcement. Both Reeves and BoE policymakers have been grappling with stubborn inflation and sluggish economic growth, making this development a welcome breather.

Shares of precious metals miner Fresnillo have risen 5% to 2217p. The stock is the leading performer in the FTSE 100 index, which has increased by 0.63%. Fresnillo reports that it is on track to achieve its full-year targets, with gold prices trending towards the higher end of expectations. This year, gold prices have soared due to geopolitical and economic uncertainties. The company has disclosed third-quarter gold production of 151.3 koz, which is a 9% increase compared to Peel Hunt's estimate of 138.7 koz. Analysts at Peel Hunt note that the company's Q3 production results were mixed against their forecasts, with lower silver and zinc output but better-than-expected gold results. Fresnillo reaffirms its outlook for 2025 and maintains its production expectations for 2026 and 2027. Including today's gains, the stock has risen approximately 268% year-to-date.

Shares of ITV in the UK have fallen 7.6% to 68.9 p, making it the biggest loser in London's mid-cap index. The bookrunner reported that Liberty Global, the largest shareholder of the British broadcaster, has cut its stake in ITV from 10% to 5%. The bookrunner indicated that LBTYA sold approximately 191 million shares. Up until Tuesday's closing, the stock had experienced a 1.29% increase this year.

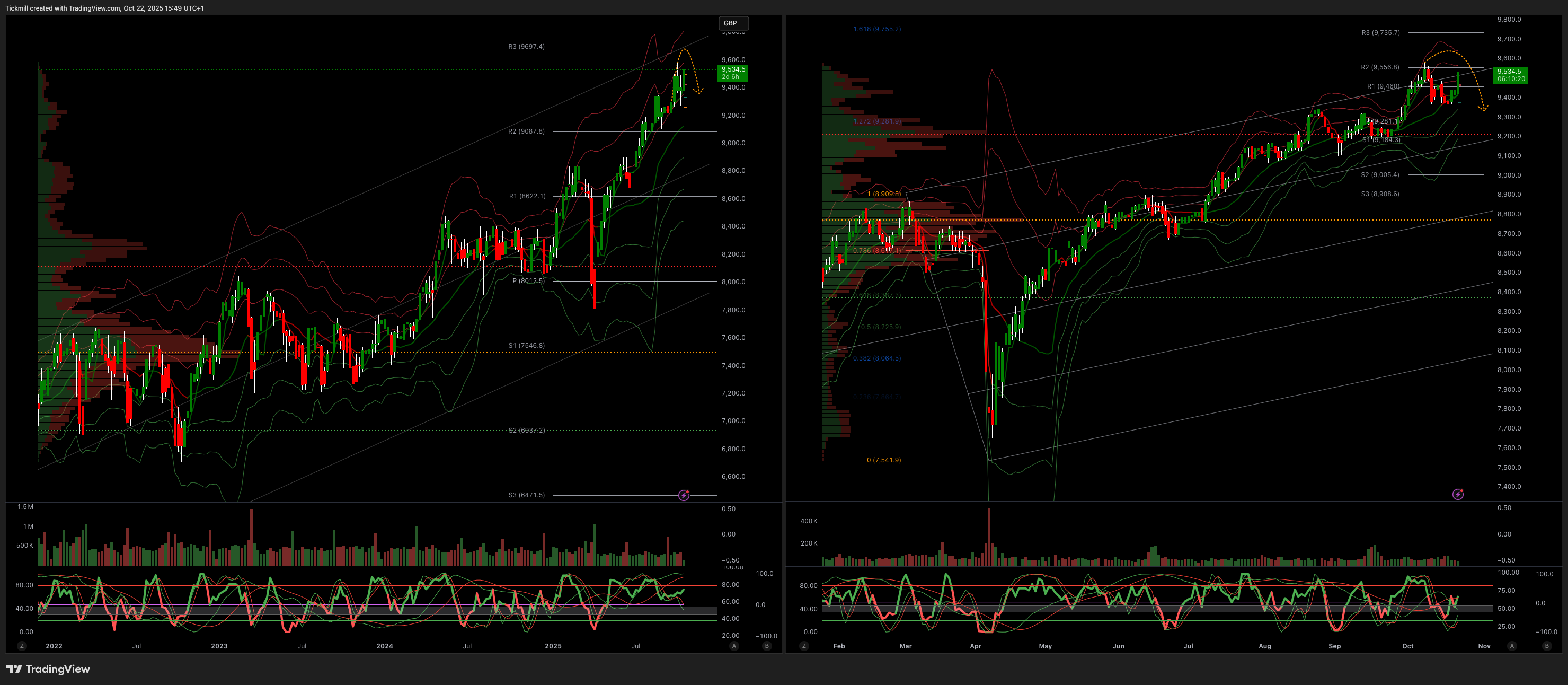

Technical & Trade View

FTSE Bias: Bullish Above Bearish below 9330

Primary support 9000

Below 9300 opens 9000

Primary objective 9600

Daily VWAP Bullish

Weekly VWAP Bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!