Crude Rebounding Despite Fresh OPEC+ Output Increase

Crude Higher on Monday

Oil prices are rising on Monday, despite the latest OPEC+ output hike, as demand grows against the backdrop of a weaker USD and elevated Russi-Ukraine risks. A fresh drop in the US NFP data on Friday has seen Fed easing expectations rising near-term. The market is now pricing in a 90% likelihood of a cut this month with expectations for a further .5% of easing ahead of year end seen rising also. With downside USD risks growing, risk assets look poised to gain near-term.

OPEC+ Output Increase

Indeed, the rally in crude today comes despite OPEC+ announcing a further output increase to take effect next week. The group will pull back curbs for a sixth consecutive month, returning nearly 200k bpd to the market. However, the level is far below the increases we’ve seen in prior months and is seemingly being ignore by the market for now.

Russia-Ukraine Conflict

Ongoing, and seemingly escalating, conflict between Russia and Ukraine is also feeding into higher crude prices. Huge Russian drone strikes on Kyviv in recent days show that the war is far from over. Indeed, with peace talks stalled, the supply risks for crude remain a key price driver and oil prices look set to push higher while the conflict continues.

US Inflation

Looking ahead this week, traders will be watching the USD response to Thursday’s inflation data. If we see a fresh move lower in USD this should help drive crude prices higher near-term. However, if USD rebounds on the data (upside CPI beat), this could put fresh pressure on crude and broader risk assets.

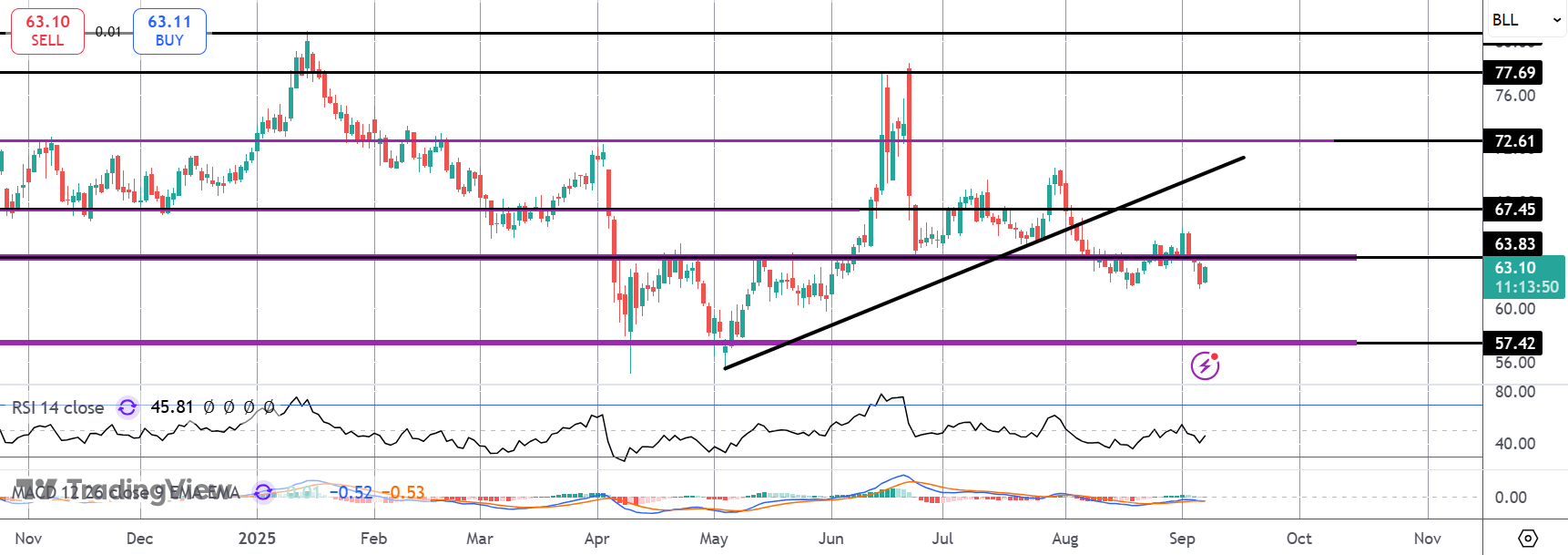

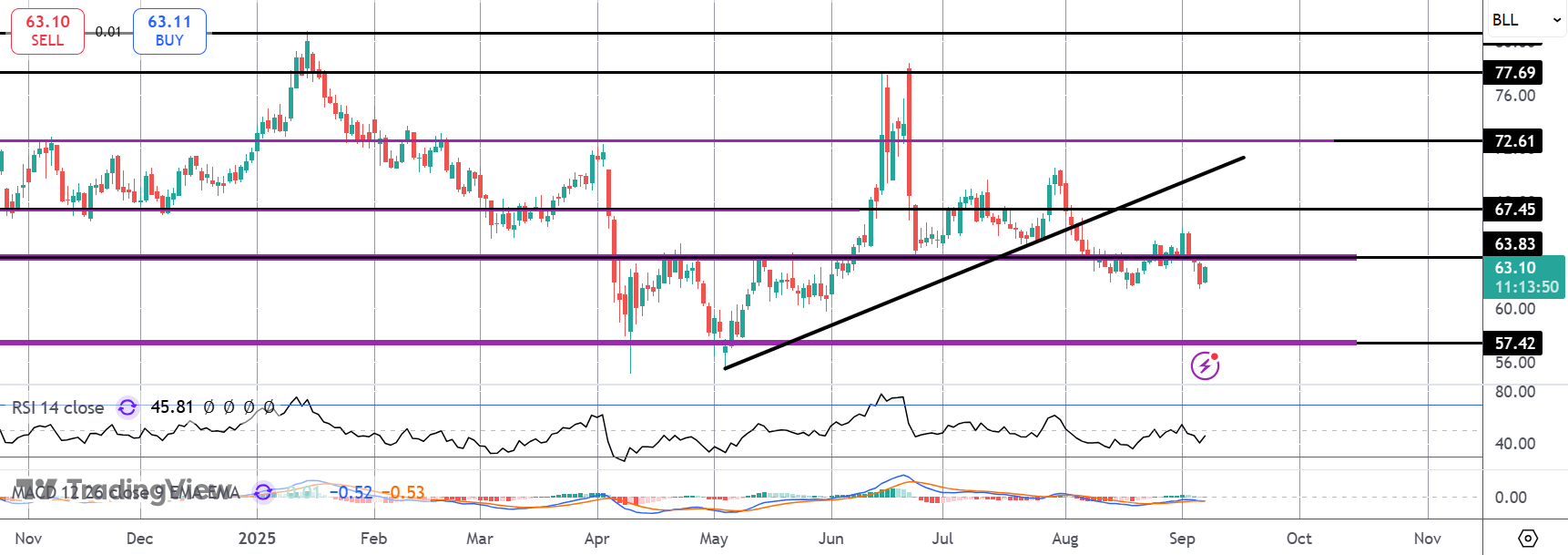

Technical Views

CL

For now, crude prices remain below the 63.83 level and while that level acts as a cap, focus is on a fresh move lower and a test of the 57.42 level next. Topside, bulls need to get price back above 67.45 to turn focus towards a full recovery near-term. Momentum studies look mostly neutral for now.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.